As Senior Product Designer on the mobile app team, I led the end-to-end redesign of our B2B payment application for merchants. Over 6 months, we transformed the app from V1 to V2, resulting in positive ROI and significantly improved user satisfaction.

As Senior Product Designer on the mobile app team, I led the end-to-end redesign of our B2B payment application for merchants. Over 6 months, we transformed the app from V1 to V2, resulting in positive ROI and significantly improved user satisfaction.

As Senior Product Designer on the mobile app team, I led the end-to-end redesign of our B2B payment application for merchants. Over 6 months, we transformed the app from V1 to V2, resulting in positive ROI and significantly improved user satisfaction.

Synthesising research

Synthesising research

Synthesising research

I created journey maps and personas which helped to communicate user goals and identify opportunities for improvement. This highlighted unmet needs - particularly around integrating with third-party accounting tools.

Navigation overview

Navigation overview

Navigation overview

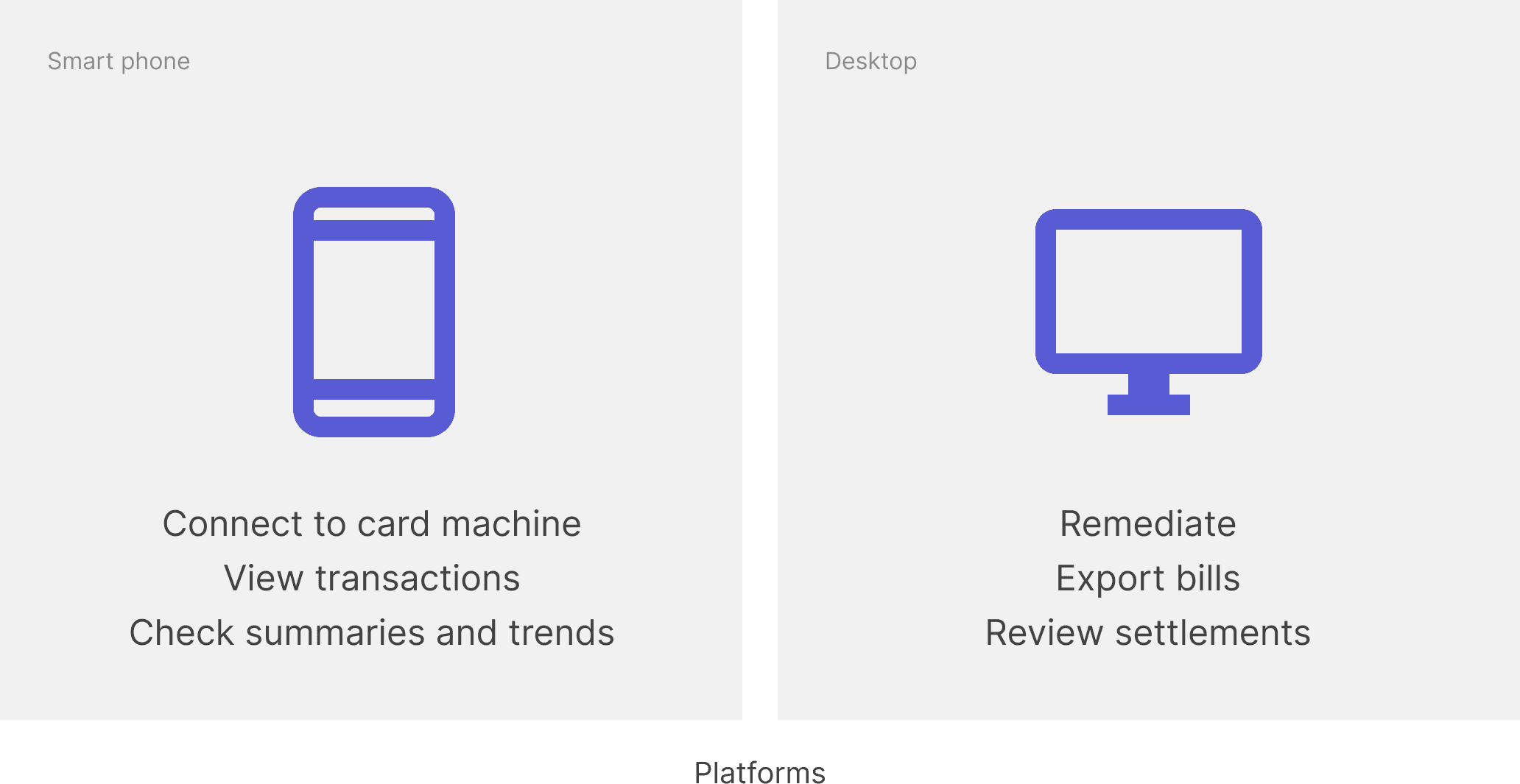

I redesigned the navigation structure with four core sections:

Dashboard: Payment analytics and summaries

Transactions: Searchable, filterable transaction history

Digital Billing: Paperless billing management

Account: Settings and profile management

Payments dashboard

Payments dashboard

Payments dashboard

Our dashboard presented analytics, I selected payment summaries and trends, which provided insights such as average spend, and busy periods. We based these choices on user research, we really wanted to improve how it did this to greater inform and empower our users.

For larger businesses with multiple locations, we had to provide dedicated features for viewing and comparing transactions. Users can select the location button to access their locations and can view them as separate or combined sources of incomes.

I knew that comparing transaction volume over time could help provide context and inform merchants into making actionable decisions, so added a powerful chart.

Finding a transaction

Finding a transaction

Finding a transaction

Card transactions had low discoverability and yet a shopkeeper would often need to inspect a transaction on a daily basis, this hindered user access and created an uneccesary complex user journey. With this understanding, I redesigned the primary navigation and prioritised this journey accordingly.

Card transactions had low discoverability and yet a shopkeeper would often need to inspect a transaction on a daily basis, this hindered user access and created an uneccesary complex user journey. With this understanding, I redesigned the primary navigation and prioritised this journey accordingly.

Card transactions had low discoverability and yet a shopkeeper would often need to inspect a transaction on a daily basis, this hindered user access and created an uneccesary complex user journey. With this understanding, I redesigned the primary navigation and prioritised this journey accordingly.

Transaction reporting for accounting

Transaction reporting for accounting

Transaction reporting for accounting

With the export feature, users could now easily share there card transaction data with their accountant or accounting software, thus combining it with the rest of their income and costs. A report could now be exported. This gave merchants a solution which they didn't previously have.

User testing improvements

User testing improvements

User testing improvements

After completing rounds of usability tests which I broadcasted to my team using remote viewing rooms, TV's, cables, and a lot of coordination. I designed a System Usability Scale (SUS) for measuring usability.

Early prototype testing revealed critical user needs:

Transaction Count Visibility: Merchants wanted to see number of transactions, not just monetary totals

Location Persistence: Multi-location users expected their location selection to persist across sessions

After completing rounds of usability tests which I broadcasted to my team using remote viewing rooms, TV's, cables, and a lot of coordination. I designed a System Usability Scale (SUS) for measuring usability.

Early prototype testing revealed critical user needs:

Transaction Count Visibility: Merchants wanted to see number of transactions, not just monetary totals

Location Persistence: Multi-location users expected their location selection to persist across sessions

After completing rounds of usability tests which I broadcasted to my team using remote viewing rooms, TV's, cables, and a lot of coordination. I designed a System Usability Scale (SUS) for measuring usability.

Early prototype testing revealed critical user needs:

Transaction Count Visibility: Merchants wanted to see number of transactions, not just monetary totals

Location Persistence: Multi-location users expected their location selection to persist across sessions

Launch & results

Launch & results

Launch & results

Originally a merchant couldn't easily find and troubleshoot a particular transaction they had made.

We introduced summaries of sales and refunds volume on the dashboard and made the transaction list page easily accessible from the app's menu.

Users had greater filtering options - I designed full-screen filter views, because they are convenient when displaying longer sets of filters since they make for a more focused experience and allow for more screen estate.

⭐️ Monthly active native app users increased to 43.5k across both iOS and Android.

⭐️ The app received a rating of 3.9 stars on the app store, reflecting positive customer feedback and satisfaction with the improved user experience.

⭐️ Designing in-app digital billing, thus removing completely printing and postage costs of the physical bills saved the business £1 million annually.

£1,557.35

TOTAL BALANCE

11% vs Monday last week

£75

£50

£25

£0

Yesterday

Today

06:00

12:00

18:00

24:00

Activity

See all

-£4.75

Debit

11:31

£3.00

Credit

11:37

£3.00

Debit

11:37

£2.50

Debit

12:02

Ocra stores

Summary

Transactions

Billing

Account

As Senior Product Designer on the mobile app team, I led the end-to-end redesign of our B2B payment application for merchants. Over 6 months, we transformed the app from V1 to V2, resulting in positive ROI and significantly improved user satisfaction.

As Senior Product Designer on the mobile app team, I led the end-to-end redesign of our B2B payment application for merchants. Over 6 months, we transformed the app from V1 to V2, resulting in positive ROI and significantly improved user satisfaction.

£1,557.35

TOTAL BALANCE

11% vs Monday last week

£75

£50

£25

£0

Yesterday

Today

06:00

12:00

18:00

24:00

Activity

See all

-£4.75

Debit

11:31

£3.00

Credit

11:37

£3.00

Debit

11:37

£2.50

Debit

12:02

Ocra stores

Summary

Transactions

Billing

Account

£1,557.35

TOTAL BALANCE

11% vs Monday last week

£75

£50

£25

£0

Yesterday

Today

06:00

12:00

18:00

24:00

Activity

See all

-£4.75

Debit

11:31

£3.00

Credit

11:37

£3.00

Debit

11:37

£2.50

Debit

12:02

Ocra stores

Summary

Transactions

Billing

Account

Navigation overview

Navigation overview

I redesigned the navigation structure with four core sections:

Dashboard: Payment analytics and summaries

Transactions: Searchable, filterable transaction history

Digital Billing: Paperless billing management

Account: Settings and profile management

I redesigned the navigation structure with four core sections:

Dashboard: Payment analytics and summaries

Transactions: Searchable, filterable transaction history

Digital Billing: Paperless billing management

Account: Settings and profile management

Payments dashboard

Our dashboard presented analytics, I selected payment summaries and trends, which provided insights such as average spend, and busy periods. We based these choices on user research, we really wanted to improve how it did this to greater inform and empower our users.

For larger businesses with multiple locations, we had to provide dedicated features for viewing and comparing transactions. Users can select the location button to access their locations and can view them as separate or combined sources of incomes.

I knew that comparing transaction volume over time could help provide context and inform merchants into making actionable decisions, so added a powerful chart.

Our dashboard presented analytics, I selected payment summaries and trends, which provided insights such as average spend, and busy periods. We based these choices on user research, we really wanted to improve how it did this to greater inform and empower our users.

For larger businesses with multiple locations, we had to provide dedicated features for viewing and comparing transactions. Users can select the location button to access their locations and can view them as separate or combined sources of incomes.

I knew that comparing transaction volume over time could help provide context and inform merchants into making actionable decisions, so added a powerful chart.

Finding a transaction

Card transactions had low discoverability and yet a shopkeeper would often need to inspect a transaction on a daily basis, this hindered user access and created an uneccesary complex user journey. With this understanding, I redesigned the primary navigation and prioritised this journey accordingly.

Card transactions had low discoverability and yet a shopkeeper would often need to inspect a transaction on a daily basis, this hindered user access and created an uneccesary complex user journey. With this understanding, I redesigned the primary navigation and prioritised this journey accordingly.

Transaction reporting for accounting

With the export feature, users could now easily share there card transaction data with their accountant or accounting software, thus combining it with the rest of their income and costs. A report could now be exported. This gave merchants a solution which they didn't previously have.

With the export feature, users could now easily share there card transaction data with their accountant or accounting software, thus combining it with the rest of their income and costs. A report could now be exported. This gave merchants a solution which they didn't previously have.

User testing improvements

User testing improvements

After completing rounds of usability tests which I broadcasted to my team using remote viewing rooms, TV's, cables, and a lot of coordination. I designed a System Usability Scale (SUS) for measuring usability.

Early prototype testing revealed critical user needs:

Transaction Count Visibility: Merchants wanted to see number of transactions, not just monetary totals

Location Persistence: Multi-location users expected their location selection to persist across sessions

After completing rounds of usability tests which I broadcasted to my team using remote viewing rooms, TV's, cables, and a lot of coordination. I designed a System Usability Scale (SUS) for measuring usability.

Early prototype testing revealed critical user needs:

Transaction Count Visibility: Merchants wanted to see number of transactions, not just monetary totals

Location Persistence: Multi-location users expected their location selection to persist across sessions

Launch & results

Originally a merchant couldn't easily find and troubleshoot a particular transaction they had made.

We introduced summaries of sales and refunds volume on the dashboard and made the transaction list page easily accessible from the app's menu.

Users had greater filtering options - I designed full-screen filter views, because they are convenient when displaying longer sets of filters since they make for a more focused experience and allow for more screen estate.

⭐️ Monthly active native app users increased to 43.5k across both iOS and Android.

⭐️ The app received a rating of 3.9 stars on the app store, reflecting positive customer feedback and satisfaction with the improved user experience.

⭐️ Designing in-app digital billing, thus removing completely printing and postage costs of the physical bills saved the business £1 million annually.

Originally a merchant couldn't easily find and troubleshoot a particular transaction they had made.

We introduced summaries of sales and refunds volume on the dashboard and made the transaction list page easily accessible from the app's menu.

Users had greater filtering options - I designed full-screen filter views, because they are convenient when displaying longer sets of filters since they make for a more focused experience and allow for more screen estate.

⭐️ Monthly active native app users increased to 43.5k across both iOS and Android.

⭐️ The app received a rating of 3.9 stars on the app store, reflecting positive customer feedback and satisfaction with the improved user experience.

⭐️ Designing in-app digital billing, thus removing completely printing and postage costs of the physical bills saved the business £1 million annually.

£1,557.35

TOTAL BALANCE

11% vs Monday last week

£75

£50

£25

£0

Yesterday

Today

06:00

12:00

18:00

24:00

Activity

See all

-£4.75

Debit

11:31

£3.00

Credit

11:37

£3.00

Debit

11:37

£2.50

Debit

12:02

Ocra stores

Summary

Transactions

Billing

Account